Have a plan for income in retirement.

Know how much you can spend and when to make adjustments.

Customized guidance on retirement income management

The Retirement Income Plan Review is for people approaching or in retirement seeking to understand how much they can spend, when and how to adjust spending for changing economic and market conditions, and how to develop distribution plans for tax efficiency.

This engagement is a focused analysis of your core retirement income plan.

See how you can navigate retirement so you can live with confidence

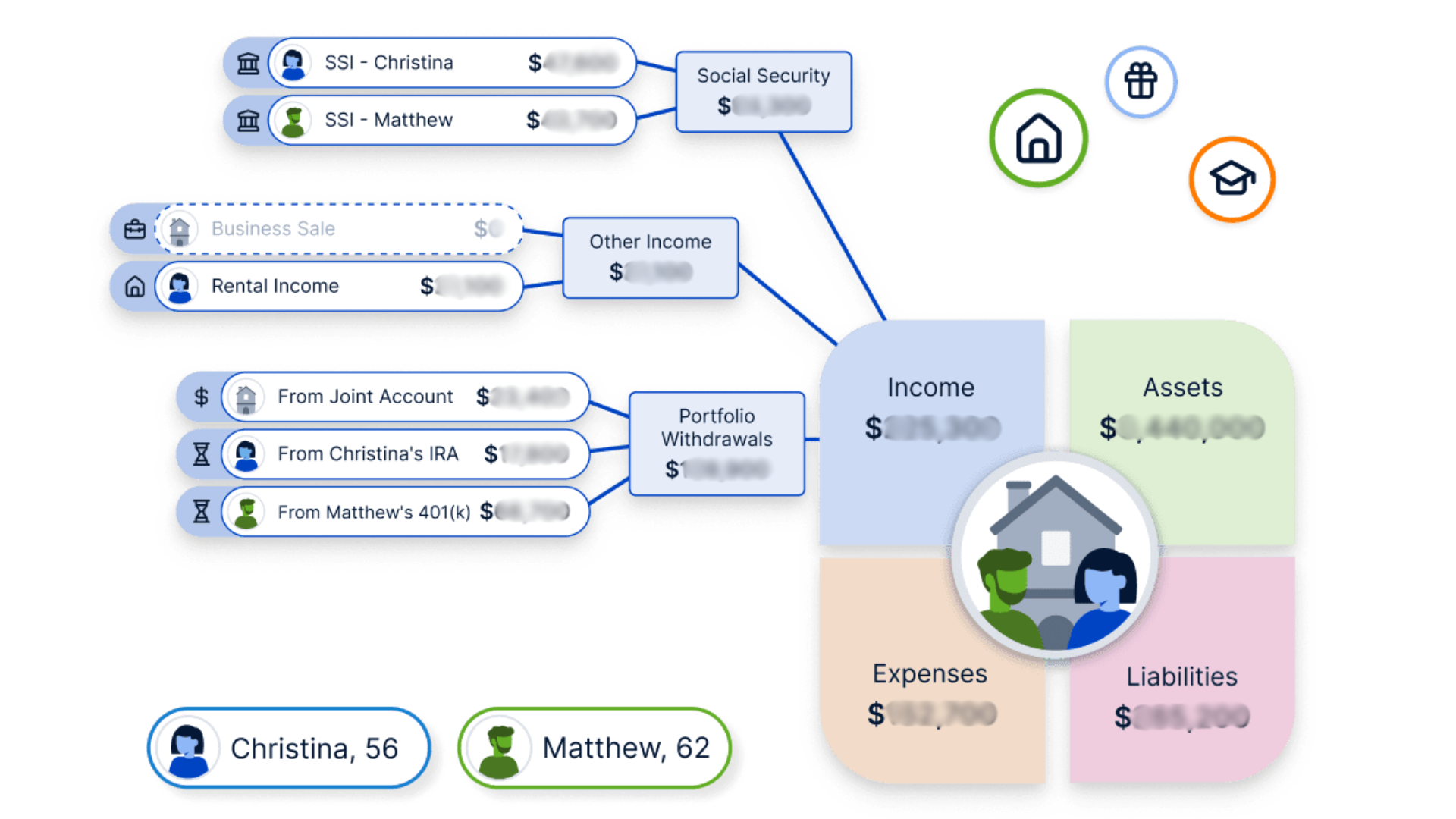

One-page dashboard of your financial picture

Get a clear, one-page view where all of your life’s events come together and see how your financial picture changes over time. You can see your financial life today and plan for life events in the future, such as Roth conversions, Social Security, asset purchases, and longevity planning.

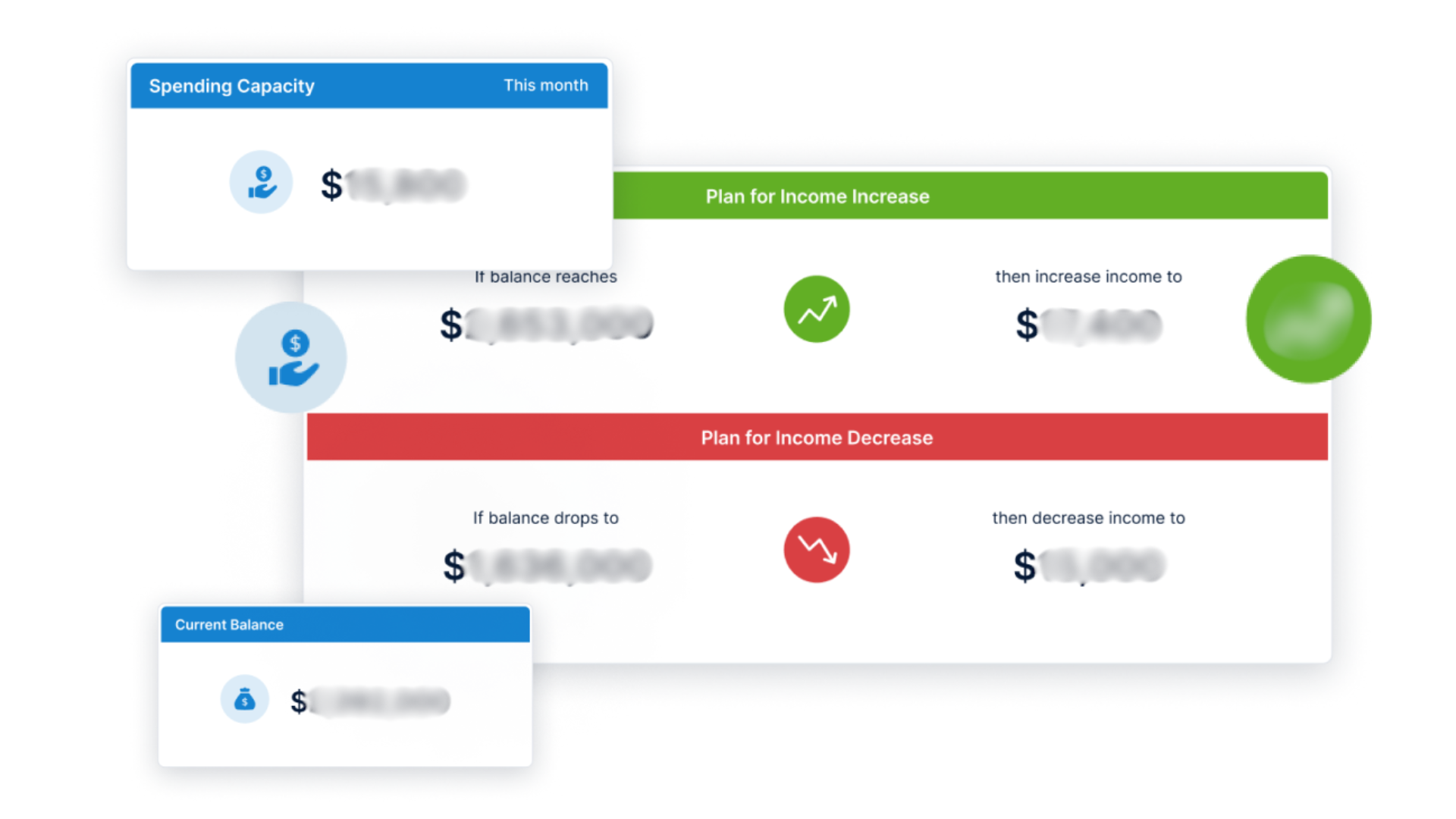

GPS to retirement distribution sufficiency

Retirement planning is about the clear tradeoff between spending and the chances of a future spending adjustment. We will craft a plan for how you may adjust your spending (both up and down) as circumstances change.

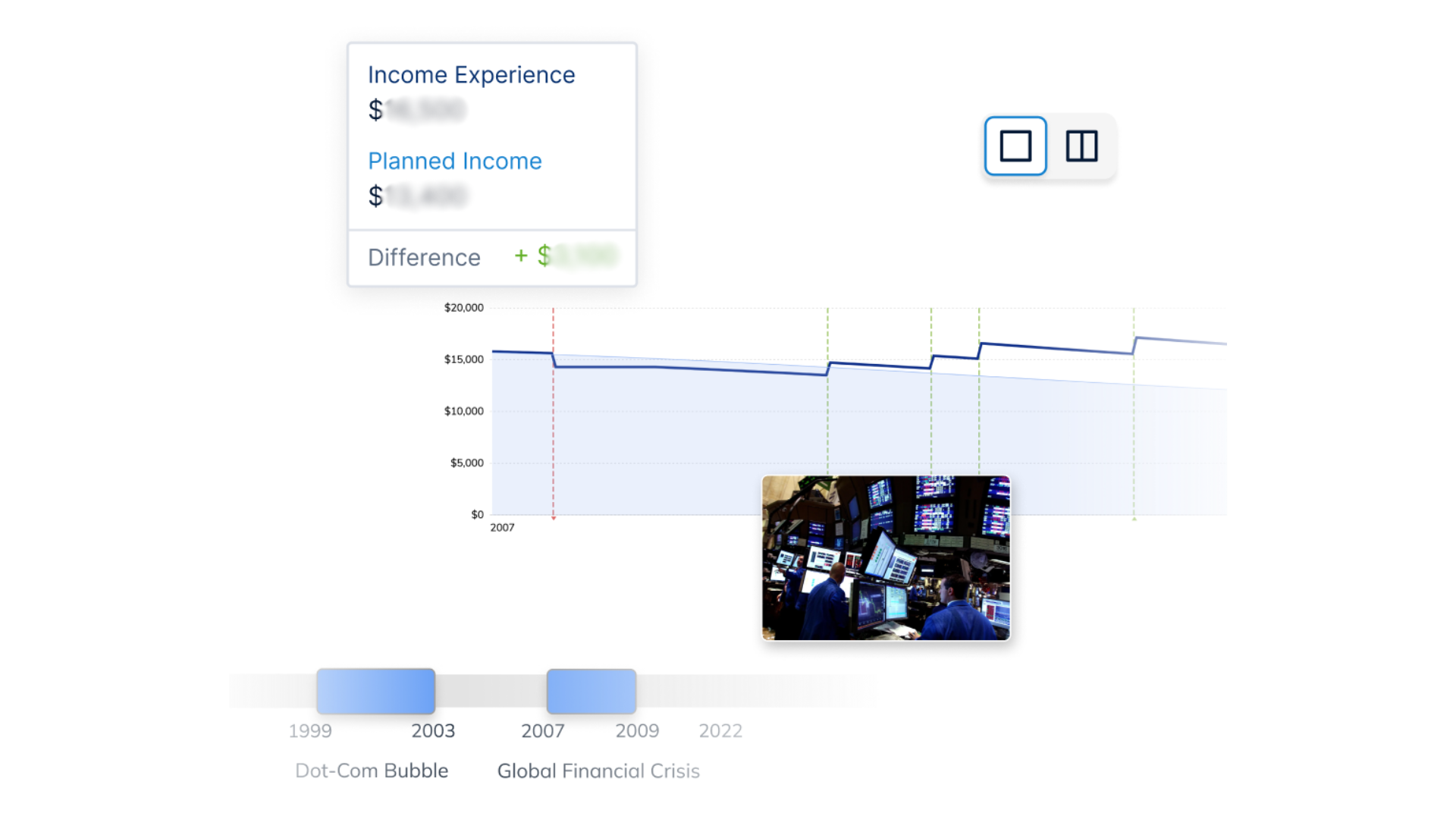

Stress test your retirement income plan

Perform a stress test to see how your retirement income plan would have navigated some of the most difficult periods in history, such as the Global Financial Crisis, the Dot-Com Bubble, 1970s Stagflation, and the Great Depression. We can show you how long it would have taken for your spending and account balances to recover from those historical events.

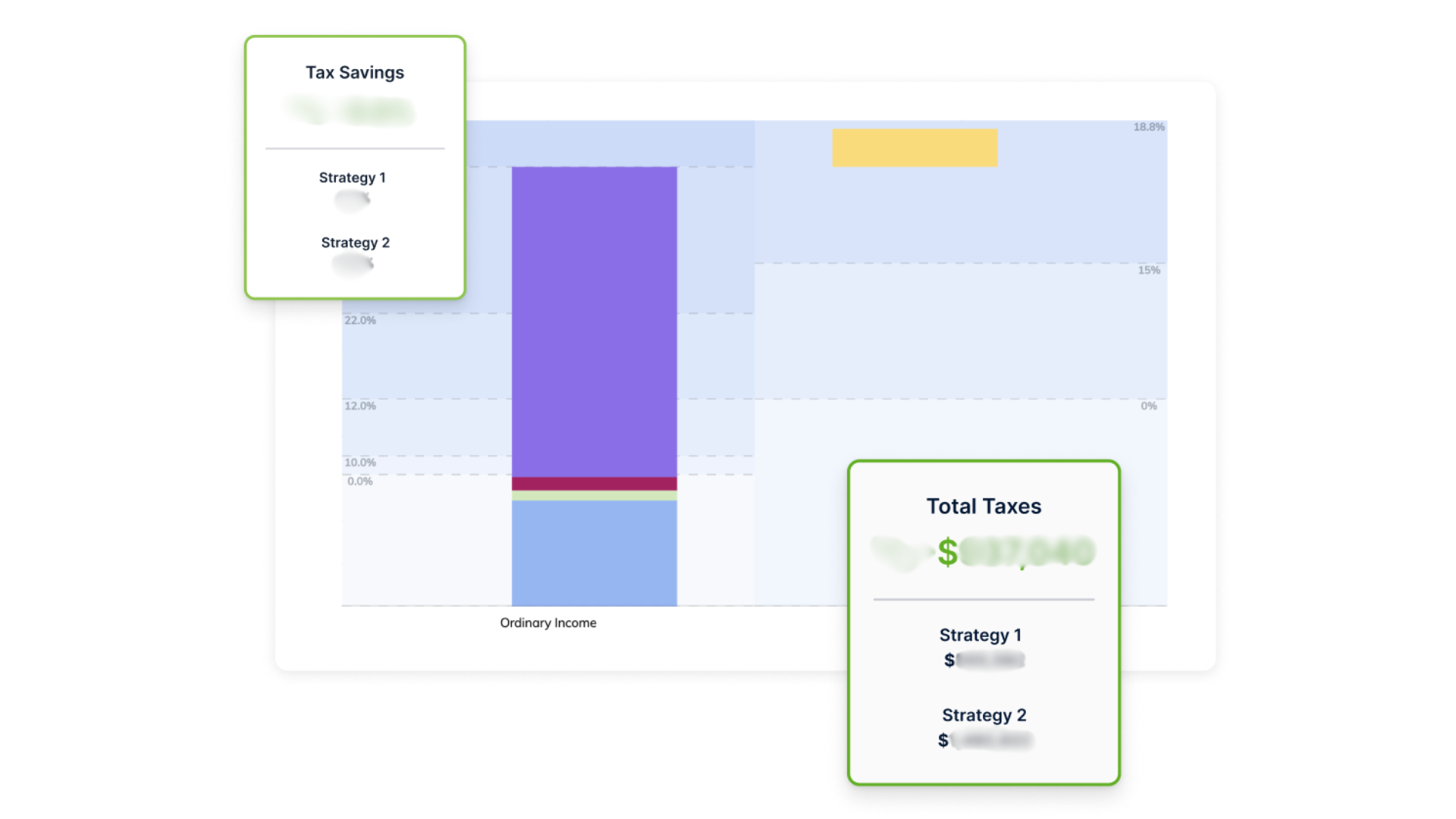

Insights into key retirement tax questions

Once you know how much you can spend for retirement sufficiency, the next actions are reviewing which accounts you should take distributions from and if you should consider Roth conversions. We can help answer these questions and estimate the value of a tax-smart distribution plan that can keep more of your hard-earned money to use towards the things you want to do.

All images are used for illustrative purposes only.

Retirement Income Plan Review process

The Retirement Income Plan Review process is simple.

Introductory Conversation

Learning about your planning priorities, assessing a mutual fit, and sharing about our services and pricing to affirm next steps.

Agreement Signing

Sending a client agreement for your review and e-signature.

Getting Organized

Sending our client intake form to collect necessary information through simple but secure data gathering software.

Review Presentation

Presenting the findings of your Retirement Income Plan Review, which then brings the engagement to a close.

Hourly Financial Advising Services

As life circumstances change, you may come back for the financial advice and support you want in future hourly engagements.

There is so much value in having clarity

The Retirement Income Plan Review has a straightforward flat fee.

Flat fee* | $996 |

*One half (50%) of the fee is collected upon execution of the agreement, and the remaining balance is due upon presentation of our recommendations.

Get the objective retirement income management advice you are seeking at an affordable price.